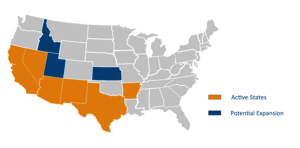

Geographic Focus

- Targeted to select states

- Major cities with >1 million+ population

- Solid market demographics

- Submarkets within 60 miles of MSA

Looking to Sell? Get in touch with us to learn more about CALCAP’s investment criteria and our acquisition and disposition process and requirements.

CONTACT US

CALCAP’s investment approach starts with deep understanding of the markets we invest in.

• Focused on markets with strong population and employment

growth projections and where there are solid economic drivers

and industry diversification

• Sub-markets with good supply/demand fundamentals

• Markets showing positive demographic trends

We are narrowly focused on demographically driven real estate asset investments.

• Generally look for assets that can be acquired below replacement cost and can generate above market returns to our investors

• Focused on single family and multi-family assets between 75-350 units where we can drive revenue growth with value add asset rehabilitation and re-positioning strategies

• Predictable income from current operations

• Steady and consistent cash flow

• Cash flow driven investor returns vs. price appreciation driven investor returns

CALCAP disposition process is based on a disciplined and subjective process which has allowed it to maximize investor returns through timely asset sales.

Considerations include: